Variable Mortgage Rates All the Rage

Posted on Jan 31, 2025

People are choosing Variables for these reasons:

People are choosing Variables for these reasons: - They expect the Bank of Canada isn’t done easing

- Floating rates are finally on par with fixed rates

- It’s therefore easier to qualify for variables, given how the government’s mortgage stress test calculation works

- Standard variable mortgages have prepayment penalties of just three months’ interest (fixed...

Reduce Time on your Digital Device

Posted on Jan 08, 2025

Most of us have boundaries in multiple areas of our lives: at work, with our colleagues and boss, and at home, with our partner, children and friends.

Most of us have boundaries in multiple areas of our lives: at work, with our colleagues and boss, and at home, with our partner, children and friends. But when it comes to our phones, most of us have a “porous boundary, and likely no boundary,” says Dr. Aditi Nerurkar, Harvard stress and burnout expert. That's why so many of us feel like we have a...

NEW: BC Home Flipping Tax

Posted on Jan 07, 2025

As of January 1, 2025, the BC Home Flipping Tax is now in effect. This new tax is distinct from the existing federal property flipping tax and specifically targets short-term property sales within British Columbia.

As of January 1, 2025, the BC Home Flipping Tax is now in effect. This new tax is distinct from the existing federal property flipping tax and specifically targets short-term property sales within British Columbia.Here’s how it works:

- The tax applies to income from sales of residential properties, presale contracts, or assignments owned for less tha...

General Real Estate Market Update

Posted on Dec 19, 2024

Market Trends and Activity:

Market Trends and Activity:- Sales in October and November showed year-over-year increases but remain below average, signaling gradual market recovery.

- Inventory remains elevated due to increased new listings and slower-than-average sales, though a seasonal decline is expected as the year ends.

- The Bank of Canada im...

New Home Flipping Tax

Posted on Dec 06, 2024 in taxes

Starting January 1, 2025, the new BC Home Flipping Tax will add another layer of tax consideration for British Columbians who sell residential property within a short timeframe. This tax will be in addition to the existing federal property flipping tax introduced by the Canada Revenue Agency in 2023. While there are similarities between the two tax...

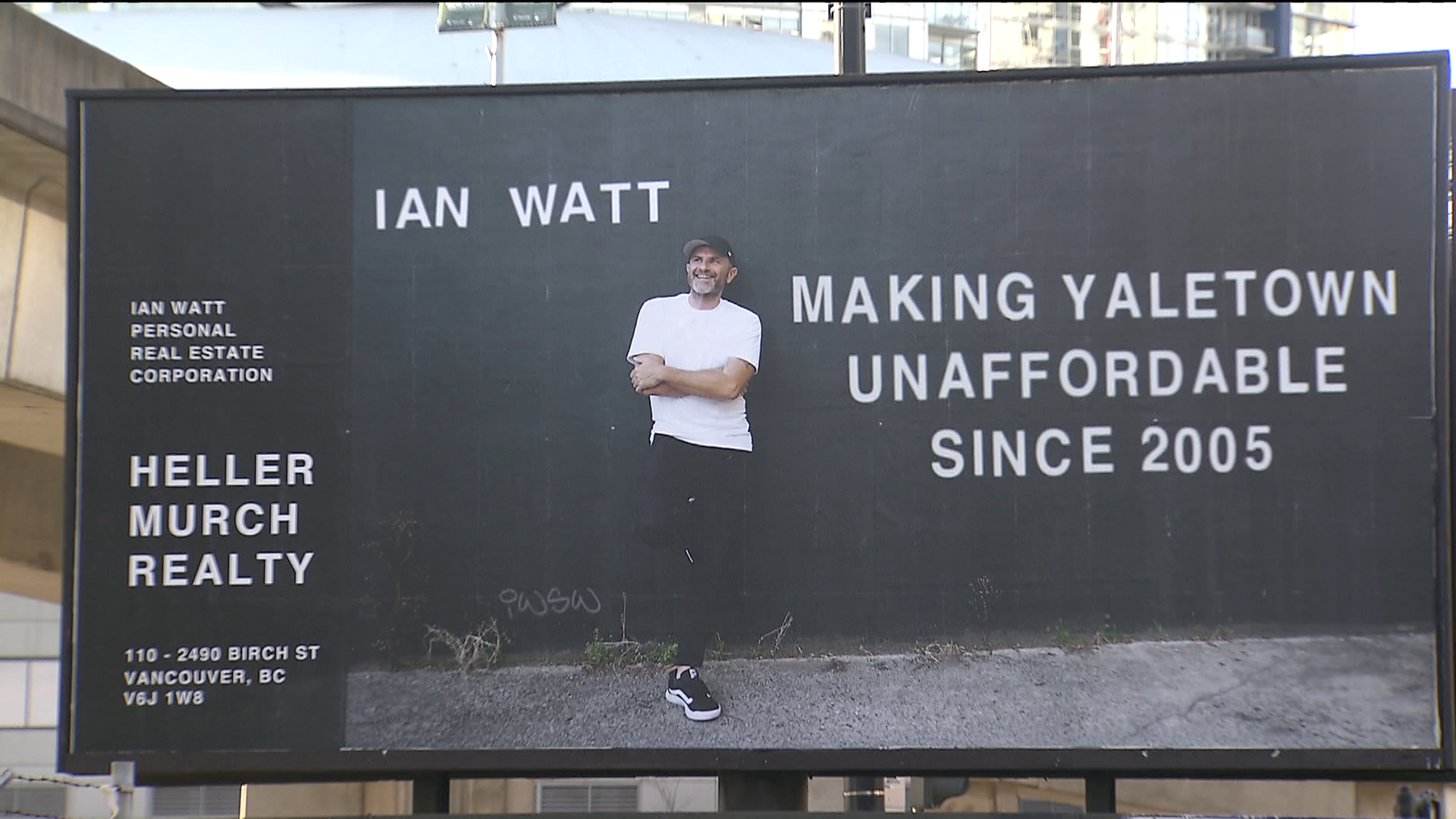

polarizing advertising

Posted on Dec 05, 2024

This article highlights the rollercoaster seen when emotions and real estate collide in a polarizing way!

‘Making Yaletown Unaffordable:’ realtor faces threats over Vancouver billboard. Read more here.